UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☒ | Filed by the Registrant | ☐ | Filed by a party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | |

| Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

THE FIRST BANCSHARES, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY) | |

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

April 12, 202310, 2024

Dear Shareholder:

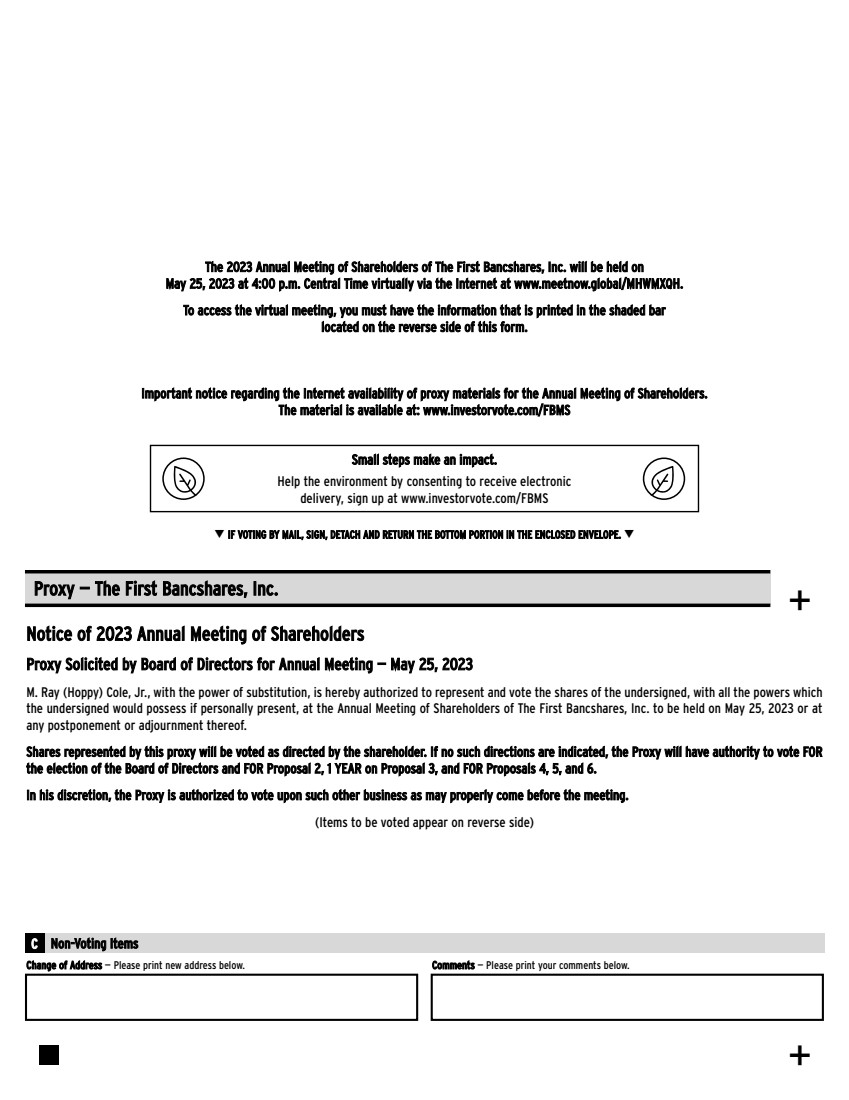

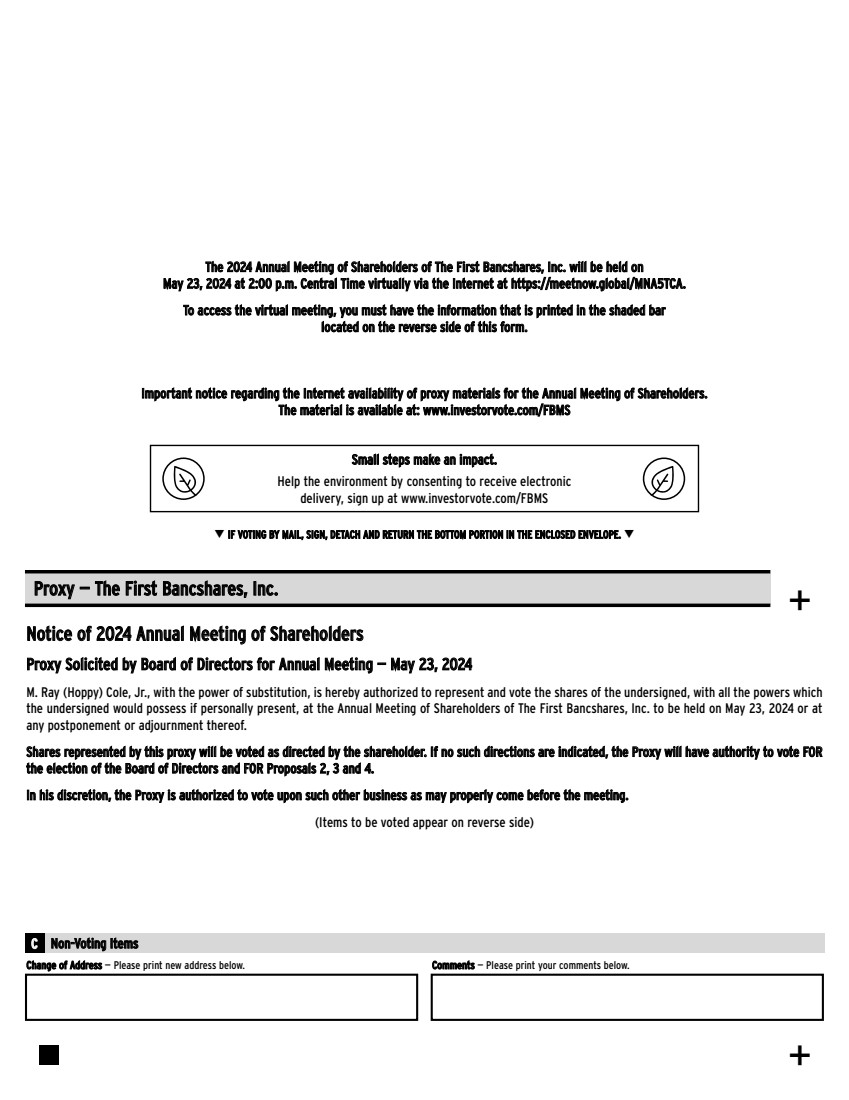

We cordially invite you to attend the 20232024 Annual Meeting of Shareholders of The First Bancshares, Inc., the holding company for The First Bank, which will be held on Thursday, May 25, 202323, 2024 at 4:2:00 p.m. Central Time. The Company will hold the 20232024 Annual Meeting of Shareholders (the “Annual Meeting”) in a virtual-only meeting format, via the internet at www.meetnow.global/MHWMXQHhttps://meetnow.global/MNA5TCA. At the meeting, we will report on our performance in 2022.2023. We are excited about our achievements in 20222023 and our plans for the future and we look forward to discussing these with you. We hope that you can join the meeting.

The attached Notice of Annual Shareholders’ Meeting describes the formal business to be transacted at the Annual Meeting. Members of our Board of Directors and executive officer team will be present at the virtual meeting and available to answer questions regarding the Company.

It is important that your shares be represented at the Annual Meeting whether or not you are able to attend virtually. Even if you plan to attend the meeting virtually, after reading the accompanying proxy materials, the Company encourages you to promptly submit your proxy by Internet, telephone or mail as described in this proxy statement.

The Board of Directors and our employees thank you for your continued support.

| Sincerely, | |

| /s/ M. Ray (Hoppy) Cole, Jr. | |

| M. Ray (Hoppy) Cole, Jr. | |

| President, CEO and Chairman of the Board |

The First Bancshares, Inc.

Notice of Annual Meeting of Shareholders

to be held on May 25, 202323, 2024

This letter serves as your official notice that The First Bancshares, Inc. (the “Company”), the holding company for The First Bank (the “Bank”), will hold its annual meeting of shareholders on Thursday, May 25, 2023,23, 2024, at 4:2:00 p.m. Central Time in a virtual-only meeting format, via the internet, for the following purposes:

| 1. | To elect |

| 2. | To approve, on an advisory basis, the compensation of the named executive officers of the Company as described in the proxy statement. |

| 3. | ||

| To approve an amendment to |

| To ratify the appointment of FORVIS, LLP |

| To vote on or transact any other business that may properly come before the meeting or any adjournment of the meeting. |

Management currently knows of no other business to be presented at the meeting.

We are very pleased that this year’s Annual Meeting will be held as a completely virtual meeting of shareholders, which will be conducted solely online via live webcast. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting: www.meetnow.global/MHWMXQHhttps://meetnow.global/MNA5TCA at the meeting date and time described in the accompanying proxy statement. There is no physical location for the Annual Meeting.

We are excited to embrace the latest technology to provide expanded access, improved communication and cost savings for our shareholders and the Company. We believe that hosting a virtual meeting will enable greater shareholder attendance and participation from any location around the world.

The Board of Directors of the Company unanimously recommends that shareholders vote “FOR” the election of the four Class Itwelve director nominees and one Class III director nominee recommended by the Board of Directors in this proxy statement, “FOR” the approval, on an advisory basis, of the compensation of our named executive officers as described in thethis proxy statement, in favor of holding an advisory vote on the compensation of our named executive officers EVERY YEAR, “FOR” the approval of an amendment to the Company’s Amended and Restated Articles of Incorporation to increase the number of authorized shares of common stock, “FOR” the approval of an amendment to the Company’s Amended and Restated Articles of Incorporation to declassify the Board of Directors,The First Bancshares, Inc. 2007 Stock Incentive Plan, and “FOR” the ratification of the appointment of FORVIS, LLP as the Company’s independent registered public accounting firm for the fiscal year 2023.

2024.

The Securities and Exchange Commission (the “SEC”) allows issuers to furnish proxy materials to their shareholders over the Internet. You will not receive a printed copy of the proxy materials, unless specifically requested. The Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review all of the important information contained in the proxy materials.

| 2 |

The Notice of Internet Availability of Proxy Materials also instructs you as to how you may submit your proxy on the Internet. You are cordially invited to attend the annual meeting virtually. However, to ensure that your vote is counted at the annual meeting, please vote your proxy as promptly as possible.

| By Order of the Board of Directors, | |

| /s/ M. Ray (Hoppy) Cole, Jr. | |

| M. Ray (Hoppy) Cole, Jr. | |

| President and Chief Executive Officer and Chairman of the Board |

April 12, 202310, 2024

Hattiesburg, Mississippi

| 3 |

IMPORTANT NOTICE REGARDING INTERNET AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD MAY 25, 202323, 2024

Proxy materials for the Annual Meeting of Shareholders of The First Bancshares, Inc., which include this Notice, the proxy statement, the proxy card and the Annual Report to Shareholders for the year ended December 31, 2022,2023, are available at www.edocumentview.com/FBMS. If you would like to receive a printed or emailed copy of the proxy materials, please follow the instructions set forth in the notice that was mailed to you.

| 4 |

The First Bancshares, Inc.

6480 U.S. Highway 98 West

Hattiesburg, Mississippi 39402

Proxy Statement for Annual Meeting of

Shareholders to be Held on May 25, 202323, 2024

INTRODUCTION

Date, Time, and Place of Meeting

The Annual Meeting of Shareholders (the “Annual Meeting”) of The First Bancshares, Inc. (the “Company”), the holding company for The First Bank (the “Bank”) will be held in a virtual-only meeting format, via the internet, on Thursday, May 25, 202323, 2024 at 4:2:00 p.m. Central Time, or any adjournment(s) thereof, for the purpose of considering and voting upon the matters set out in the foregoing Notice of Annual Meeting of Shareholders. The meeting will be held in an online-only virtual format. This proxy statement is furnished to the shareholders of the Company in connection with the solicitation by the Board of Directors of proxies to be voted at the Annual Meeting. This proxy statement summarizes the information that you need to know in order to cast your vote at the Annual Meeting. You do not need to attend the virtual Annual Meeting to vote your shares of our common stock.

Unless the context indicates otherwise, all references in this proxy statement to “we,” “us,” “our,” “the Company,” and “First Bancshares” refer to The First Bancshares, Inc. and its wholly owned subsidiary, The First Bank, and the “Bank” refers to The First Bank.

Attending the Virtual Meeting as a Shareholder of Record or as a Beneficial Owner

Instruction/Q&A Section

| Q: | How can I attend the Annual Meeting? |

| A: | The Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a shareholder of the Company as of the close of business on the Record Date, or if you hold a valid proxy for the Annual Meeting. No physical meeting will be held. |

You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.meetnow.global/MHWMXQHhttps://meetnow.global/MNA5TCA. You also will be able to vote your shares online by attending the Annual Meeting by webcast.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The online meeting will begin promptly at 4:2:00 p.m. Central Time. We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

| Q: | How do I register to attend the Annual Meeting virtually on the Internet? |

| A: | If you are a registered shareholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the notice or proxy card that you received. |

| 5 |

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your holdings in The First Bancshares, Inc. along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 4:00 p.m., Central Time, on Friday, May 19, 2023.17, 2024.

You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

By email:

Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail:

Computershare

The First Bancshares, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

| Q: | Why are you holding a virtual meeting instead of a physical meeting? |

| A: | We are excited to embrace the latest technology to provide expanded access, improved communication and cost savings for our shareholders and the Company. We believe that hosting a virtual meeting will enable more of our shareholders to attend and participate in the meeting since our shareholders can participate from any location around the world with Internet access. |

| Q: | What if I have trouble accessing the Annual Meeting virtually? |

| A: | The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Note: Internet Explorer is not a supported browser. Participants should ensure that they have a strong |

Asking Questions

Shareholders may submit questions for consideration for the Annual Meeting by members of the Board of Directors and management. To facilitate the process, the Company asks shareholders to submit their questions on or before 4:00 p.m. Central Daylight Time on May 23, 202321, 2024 by accessing the virtual meeting website available at www.meetnow.global/MHWMXQHhttps://meetnow.global/MNA5TCA. Shareholders who participate in the meeting (by entering a control number as detailed above) may also submit questions regarding proposals during the meeting up until the time the relevant proposal is presented. Questions should relate to the official business of the meeting, and management and shareholders in particular.

Notice of Internet Availability of Proxy Materials

In accordance with the rules of the U.S. Securities and Exchange Commission (the “SEC”), we are permitted to furnish proxy materials, including this proxy statement and our 20222023 annual report, to shareholders by providing access to these documents online instead of mailing printed copies. Most shareholders will not receive printed copies of the proxy materials unless requested. Instead, most shareholders will only receive a notice that provides instructions on how to access and review our proxy materials online. If you would like to receive a printed or emailed copy of our proxy materials free of charge, please follow the instructions set forth in the notice that was mailed to you to request the materials. This proxy statement is available to you online at www.edocumentview.com/FBMS. If you receive more than one notice, it means that your shares are registered differently and are held in more than one account. To ensure that all shares are voted, please either vote each account over the Internet or by telephone or sign and return by mail all proxy cards.

| 6 |

The mailing address of the principal executive office of the Company is Post Office Box 15549, Hattiesburg, Mississippi, 39404-5549.

The approximate date on which this proxy statement and form of proxy are first being mailed or made available to shareholders is April 12, 2023.10, 2024.

Record Date; Voting Rights; Quorum; Matters to Be Considered at the Meeting; Vote Required

The record date for determining holders of outstanding stock of the Company entitled to notice of and to attend and vote at the Annual Meeting is March 31, 202328, 2024 (the “Record Date”). Only holders of our common stock at the close of business on the Record Date are entitled to notice of and to attend and vote at the Annual Meeting or at any adjournment or postponement thereof. As of the Record Date, there were 31,054,54631,218,321 shares of our common stock issued and outstanding, each of which is entitled to one vote on each matter presented. Shareholders do not have cumulative voting rights.

Under Mississippi law and our Amended and Restated Bylaws, as amended (the “Bylaws”), the holders of a majority of our common stock issued and outstanding and entitled to vote, present in person or represented by proxy, will constitute a quorum at the Annual Meeting. In the event there are not sufficient votes for a quorum or to approve or ratify any proposal at the time of the Annual Meeting, the Annual Meeting may be adjourned or postponed to permit the further solicitation of proxies. The inspector of election will determine whether a quorum is present at the Annual Meeting. If you are a beneficial owner (as defined below) of shares of our common stock and you do not instruct your bank, broker, trustee or other nominee how to vote your shares on any of the proposals, and your bank, broker, trustee or nominee submits a proxy with respect to your shares on a matter with respect to which discretionary voting is permitted, your shares will be counted as present at the Annual Meeting for purposes of determining whether a quorum exists. In addition, shareholders of record who are present at the Annual Meeting virtually or by proxy will be counted as present at the Annual Meeting for purposes of determining whether a quorum exists, whether or not such holder abstains from voting on any or all of the proposals. Also, a “withhold” vote with respect to the election of a director nominee will be counted for purposes of determining whether there is a quorum at the Annual Meeting, but will not be considered to have been voted for the director nominee.

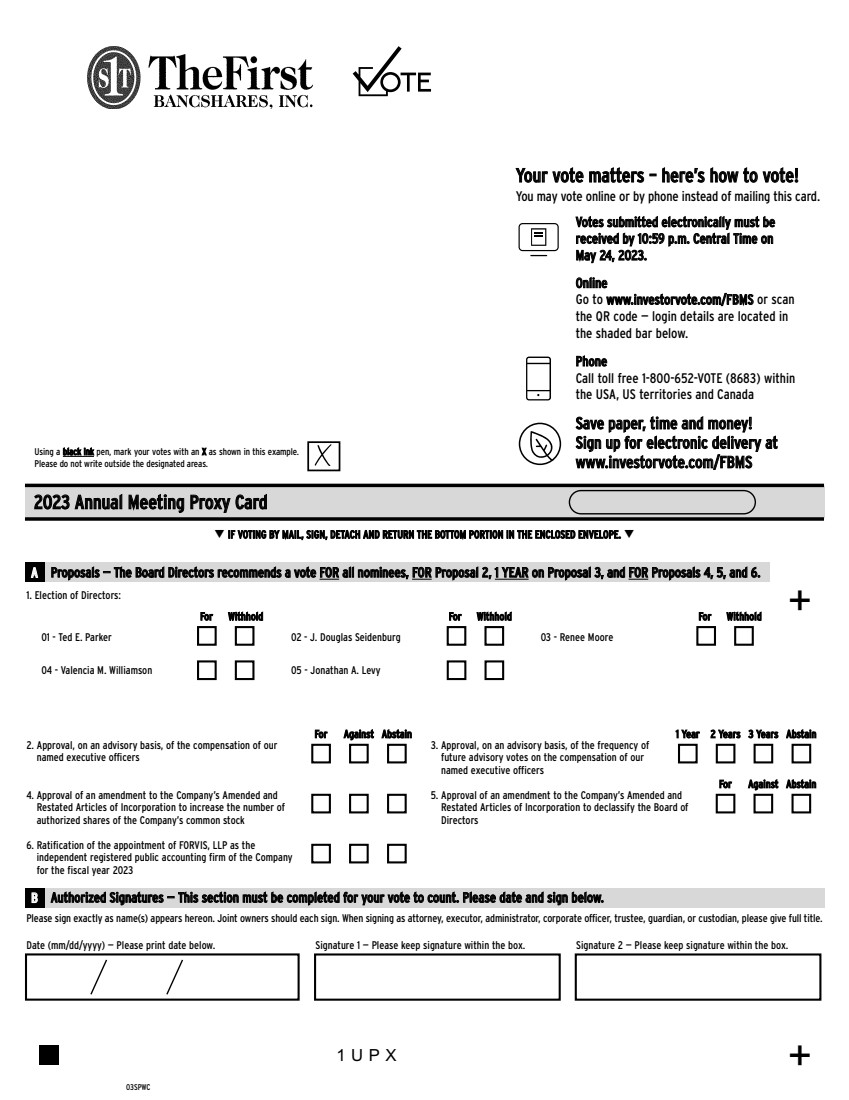

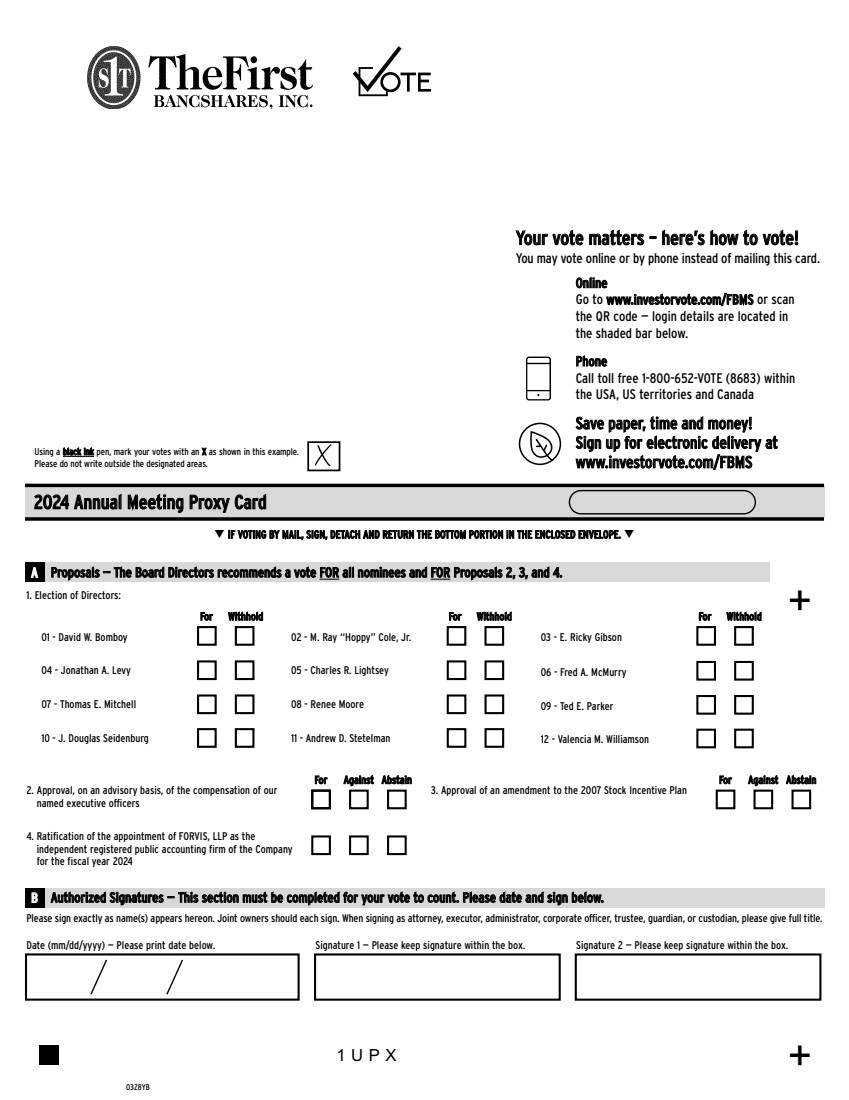

At the Annual Meeting, youshareholders will be asked to: (1) elect four Class I director nominees and one Class III director nominee; (2) approve, on an advisory basis, the compensation of our named executive officers; (3) approve, on an advisory basis, the frequency of an advisoryto vote on the compensation of the named executive officers of the Company; (4) approve an amendment to the Company’s Amended and Restated Articles of Incorporation to increase the number of authorized shares of the Company’s common stock, (5) approve an amendment to the Company’s Amended and Restated Articles of Incorporation to declassify the Board of Directors, (6) ratify the appointment of FORVIS, LLP as the Company’s independent registered public accounting firm for fiscal year 2023; and (7) consider any other matter that properly comes before the Annual Meeting. As of the date of this proxy statement, management currently knows of no other business to be presented at the meeting.following matters:

| 1. | To elect twelve director nominees named in the accompanying proxy statement; |

| 2. | To approve, on an advisory basis, the compensation of the named executive officers of the Company as described in the proxy statement; |

| 3. | To approve an amendment to The First Bancshares, Inc. 2007 Stock Incentive Plan; |

| 4. | To ratify the appointment of FORVIS, LLP as the Company’s independent registered public accounting firm for fiscal year 2024; and |

| 5. | To vote on or transact any other business that may properly come before the meeting or any adjournment of the meeting. |

The Board of Directors recommends that you vote:

| ● | FORthe election of |

| ● | FOR the approval, on an advisory basis, of the compensation of our named executive officers as described in the proxy statement; |

| ● | ||

| FOR the approval of an amendment to |

| ● | FOR the ratification of the appointment of FORVIS, LLP as the Company’s independent registered public accounting firm for the fiscal year |

By signing, dating and returning a proxy card or submitting your proxy and voting instructions via the Internet or telephone, you will give to the persons named as proxies discretionary voting authority with respect to any matter that may properly come before the Annual Meeting, and they intend to vote on any such other matter in accordance with their best judgment. We do not expect any matters to be presented for action at the Annual Meeting other than the matters described in this proxy statement. However, if any other matter does properly come before the Annual Meeting, the proxy holders will vote any shares of ouryour common stock, for which they hold a proxy to vote at the Annual Meeting, in their discretion.

Proposal | Voting Options | Vote Required | Effect of | Effect of | ||||

| No. 1: Election of | For or withhold on each director nominee | Plurality of votes cast | N/A | No effect | ||||

| No. 2: Approval, on an advisory basis, of the compensation of our named executive officers | For, against or abstain | Votes cast in favor exceed votes cast against | No effect | No effect | ||||

| No. 3: Approval | No effect | |||||||

| No. 4: |

|

|

|

|

| ||||

| For, against or abstain | Votes cast in favor exceed votes cast against | No effect | N/A |

Our directors are elected by a plurality of the votes cast. This means that the candidates receiving the highest number of “FOR” votes will be elected. Under our Bylaws, to decide any other matters that come before the Annual Meeting, the votes cast in favor of the matter must exceed the votes cast against the matter, unless a different vote is required by law, our Amended and Restated Articles of Incorporation, as amended, or our Bylaws.

Submitting Proxies and Voting Instructions

If your shares of our common stock are registered directly in your name with our transfer agent, Computershare Shareowner Services LLC, you are the shareholder of record of those shares and you will receive proxy materials from the transfer agent. You may submit your proxy and voting instructions via the Internet, telephone or by mail as further described below. Your proxy, whether submitted via the Internet, telephone or by mail, is the person designated on the proxy card to act as your proxy at the Annual Meeting to represent and vote your shares of our common stock as you directed, if applicable.

| 8 |

Holders of record may vote their shares as follows:

| ● | Submit Your Proxy and Voting Instructions via the Internet or over the |

| ◾ | You may submit your proxy and voting instructions via the Internet or telephone until 10:59 p.m. Central Time on May |

| ◾ | Please have your proxy card available and follow the instructions on the proxy card. |

| ● | Submit Your Proxy and Voting Instructions by Mail |

| ◾ | Complete, date and sign your proxy card and return it in the postage-paid envelope provided. |

| ◾ | If you are signing in a representative capacity (for example as guardian, executor, trustee, custodian, attorney or officer of a corporation), you should indicate your name and your title or capacity. |

| ◾ | Your proxy card must be received prior to May |

If you submit your proxy and voting instructions via the Internet or telephone, you do not need to mail your proxy card. The proxies will vote your shares of our common stock at the Annual Meeting as instructed by the latest dated proxy received from you, whether submitted via the Internet, telephone or by mail. You may also vote in person virtually at the Annual Meeting.

If your shares of our common stock are held by a bank, broker, trustee or other nominee, you are considered the beneficial owner of shares held in street name and these proxy materials are being forwarded to you by your bank, broker, trustee or other nominee that is considered the shareholder of record of those shares. As the beneficial owner, you have the right to direct your bank, broker, trustee or other nominee on how to vote your shares of our common stock via the Internet or by telephone, if the bank, broker, trustee or other nominee offers these options or by completing, signing, dating and returning a voting instruction form. Your bank, broker, trustee or other nominee will send you instructions on how to submit your voting instructions for your shares of our common stock.

Shares of common stock represented by properly executed proxies, unless previously revoked, will be voted at the Annual Meeting in accordance with the directions therein. If a properly executed proxy is submitted but no voting instructions are specified, such shares will be voted as the Board of Directors recommends, namely FOR each director nominee listed in this proxy statement, FOR the approval, on an advisory basis, of the compensation of our named executive officers, in favor of holding an advisory vote on the compensation of our named executive officers EVERY YEAR, FOR the approval of an amendment to the Company’s Amended and Restated Articles of Incorporation to increase the number of authorized shares of the Company’s common stock , FOR an amendment to the Company’s Amended and Restated Articles of Incorporation to declassify the Board of Directors,The First Bancshares, Inc. 2007 Stock Incentive Plan, and FOR the ratification of the appointment of the independent registered public accounting firm, and in the discretion of the person named in the proxy with respect to any other business that may come before the Annual Meeting.

Unless a new record date is fixed, your proxy will still be valid and may be used to vote shares of our common stock at the postponed or adjourned Annual Meeting.

Revoking and Changing My Vote

A proxy may be revoked or changed by a shareholder at any time prior to the exercise thereof by (1) filing with the Secretary of the Company a written revocation or a duly executed proxy bearing a later date at Post Office Box 15549, Hattiesburg, Mississippi, 39404 Attn: Corporate Secretary.Secretary, (2) submitting a duly executed proxy bearing a later date which is received by the Company at any time prior to the Annual Meeting date, or (3) voting again by telephone or on the Internet prior to 10:59 p.m. Central Time on May 22, 2024. A proxy may also be revoked if the shareholder attends the virtual Annual Meeting and elects to vote in person virtually. Your attendance alone at the Annual Meeting will not be enough to revoke your proxy.

| 9 |

Broker-Non-Votes

Rules of the New York Stock Exchange (“NYSE”) generally govern voting of shares by banks, brokers, trustees and other nominees who hold shares for beneficial owners. In making those determinations, the NYSE rules provide that the broker must first determine whether proposals presented at shareholder meetings are “discretionary” or “non-discretionary.” If you are a beneficial owner and a proposal is determined to be discretionary, then your bank, broker, trustee or other nominee is permitted under NYSE rules to vote on the proposal without receiving voting instructions from you. If you are a beneficial owner and a proposal is determined to be non-discretionary, then your bank, broker, trustee or other nominee is not permitted under NYSE rules to vote on the proposal without receiving voting instructions from you. A “broker non-vote” occurs when a bank, broker, trustee or other nominee holding shares for a beneficial owner returns a valid proxy, but does not vote on a particular proposal because it does not have discretionary authority to vote on the matter and has not received voting instructions from the shareholder for whom it is holding shares.

Under the NYSE rules, theThe proposal relating to the ratification of the appointment of the independent registered public accounting firm of the Company is a discretionary proposal. If you are a beneficial owner and you do not provide voting instructions to your bank, broker, trustee or other nominee holding shares for you, your bank, broker, trustee or other nominee may vote your shares with respect to the ratification of the appointment of the independent registered public accounting firm.

Under the rules of the NYSE, theThe proposals relating to the election of directors, and the compensation of our named executive officers and the amendment to The First Bancshares, Inc. 2007 Stock Incentive Plan are non-discretionary proposals. Accordingly, if you are a beneficial owner and you do not provide voting instructions to your bank, broker, trustee or other nominee holding shares for you, your shares will not be voted with respect to these proposals. Without your voting instructions, a broker non-vote will occur with respect to your shares on each non-discretionary proposal for which you have not provided voting instructions.

Householding

We are permitted to send a single Notice of Annual Shareholders’ Meeting (“Notice”) and any other proxy materials we choose to mail to shareholders who share the same last name and address. This procedure is called “householding” and is intended to reduce our printing and postage costs. If you would like to receive a separate copy of a proxy statement or annual report, either now or in the future, or if you would like to request householding and are currently receiving multiple copies, please contact us in writing at the following address: Post Office Box 15549, Hattiesburg, Mississippi, 39404 Attn: Corporate Secretary. In addition, if you would like to receive a separate copy of a proxy statement in the future, you may also contact us at 601-268-8998. If you hold your shares through a bank, broker or trustee or other nominee and would like to receive additional copies of the Notice and any other proxy materials, or if multiple copies of the Notice or other proxy materials are being delivered to your address and you would like to request householding, please contact your nominee.

Voting Results

The Company will publish the voting results in a Current Report on Form 8-K, which will be filed with the SEC within four business days following the Annual Meeting.If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

Other Matters

Shareholders who have questions about the matters to be voted on at the Annual Meeting or how to submit a proxy should contact Chandra B. Kidd, Secretary, The First Bancshares, Inc., P.O. Box 15549, Hattiesburg, Mississippi, 39404 or by phone at (601) 268-8998 or by e-mail at ckidd@thefirstbank.com.

PROPOSAL 1 – Election of Directors

The Board of Directors is divided into three classes with staggered terms, so that the termscurrently composed of only approximately one-third oftwelve (12) directors.

The nominees listed herein have been proposed by the Board members expire at each annual meeting. The current terms of the Class I directors will expireDirectors for election at the Annual Meeting. TheMeeting to serve a one-year term of each of the Class II directors will expire at the 2024 annual meeting of shareholders and the term of the Class III directors willto expire at the 2025 annual meeting of shareholders. Our current directors and their classes as of March 31, 2023 are as follows:

Class | |||

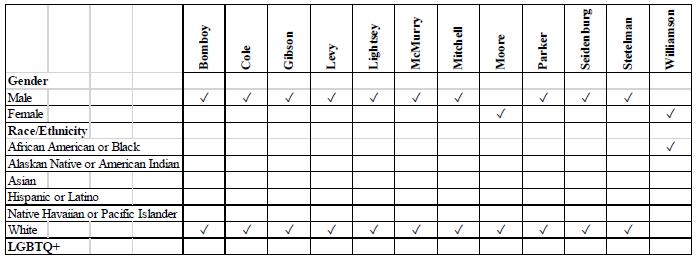

The table below sets forth certain diversity information self-reported by our directors as of December 31, 2022. Additional information on board diversity consideration is set forth under the heading “Additional Information Concerning Officers and Directors - Diversity Policy" on page 53 of this proxy statement.

| 10 |

David W. Bomboy (I)

M. Ray “Hoppy” Cole, Jr.

E. Ricky Gibson

Jonathan A. Levy (I)

Charles R. Lightsey (I)

Fred A. McMurry (I)

Thomas E. Mitchell (I)

Renee Moore (I)

Ted E. Parker (I)

J. Douglas Seidenburg (I)

Andrew D. Stetelman (I)

Valencia M. Williamson (I)

There are no arrangements or understandings between any of the directors and any other person pursuant to which he or she was selected as a director. No current director has any family relationship, as defined in Item 401 of Regulation S-K, with any other director or with any of our executive officers. During the previous 10 years, no director, person nominated to become a director, or executive officer of the Company was the subject of any legal proceeding that is material to an evaluation of the ability or integrity of any such person.

Director Nominees

Class I Director Nominees and Class III Director Nominee

At the Annual Meeting, shareholders are being asked to elect David W. Bomboy, M. Ray “Hoppy” Cole, Jr., E. Ricky Gibson, Jonathan A. Levy, Charles R. Lightsey, Fred A. McMurry, Thomas E. Mitchell, Renee Moore, Ted E. Parker, J. Douglas Seidenburg, Renee MooreAndrew D. Stetelman, and Valencia M. Williamson, as Class I director nominees each to serve a three-yearone-year term, expiring at the 20262025 annual meeting of shareholders, or until their successors are duly elected and qualified and to elect Jonathan A. Levy as a Class III directorqualified. Each nominee to serve a two-year term, expiring at the 2025 annual meeting of shareholders, or until his successor is duly elected and qualified. Ted E. Parker, J. Douglas Seidenburg and Renee Moore currently serve as Class I Directors. Valencia M. Williamson has been recommended by the Corporate Governance Committee after being identified as a potential candidate for director by Mr. Cole and does not currently serve on the Board of Directors, but she currently serves on the Board of Directors of the Bank. Jonathan A. Levy currently serves on the Board of Directors of The First Bancshares, Inc. and on the Board of Directors of the Bank. Information regarding the director nominees is provided below under “Information About Director Nominees.” Dr. Rodney D. Bennett was not nominated for re-election to the Board of Directors.

The person named as proxy on the proxy card intends to vote your shares of our common stock for the election of the four Class I director nominees, unless otherwise directed. Proxies cannot be voted for a greater number of persons than the number of nominees named in this proxy statement. If, contrary to our present expectations, any director nominee is unable to serve or for good cause will not serve, your proxy will be voted for a substitute nominee designated by the Board of Directors, unless otherwise directed.

Vote Required to Elect Director Nominees

Under our Bylaws, our directors are elected by a plurality of votes cast by the shares entitled to vote and present at the Annual Meeting.

Recommendation of the Board of Directors

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” EACH OF THE four class iTWELVE director nomineeS, and the one Class III Director Nominee as outlined above.

Information about Director Nominees and Continuing Directors

Class I Director Nominees

Renee Moore, 61, Hattiesburg, MS, has been a director of the Company since 2020 and is also a director of the Bank.

Background: Ms. Moore, CPA and partner in charge of tax services at Topp McWhorter Harvey, PLLC since 2009, is a resident of Hattiesburg, MS and has more than 30 years of public and private accounting experience. She is active in the community, serving on the Forrest General Foundation Planned Giving Committee, the 2019 Heart Walk Executive Leadership Team, and as an Ambassador for the Area Development Partnership of Greater Hattiesburg. She also served as team captain for the Leadership Division of the Area Development Partnership Forward Together Capital Campaign. Ms. Moore earned her Bachelor of Science degree in Accounting from the University of Arkansas at Little Rock.

Experience/Qualifications/Skills: Throughout Ms. Moore’s career, she has held numerous leadership positions. From CFO of a privately-held company to partner in charge of a major service division in the sixth largest firm in the state, her experience in both public accounting and industry, as well as experience gained when she and her husband owned and operated their own business, have given her a unique understanding and perspective. She also has experience as Audit Manager for a national bank. Her experience and skills are a valuable resource to the Board.

Ted E. Parker, 63, has been a director of the Company since 1995 and is also a director of the Bank.

Background: Mr. Parker has been in the stocker-grazer cattle business for more than 30 years as the owner and operator of Ted Parker Farms LLC. He attended the University of Southern Mississippi and served as a licensed commodity floor broker at the Chicago Mercantile Exchange from 1982 to 1983. He served on Bayer Animal Health Advisory Board from 2010 to 2016 and on the Marketing and International Trade Committee of the National Cattleman’s Beef Association from 2015 to 2017 and currently serves on the Cattle Fax board of directors. He served as a board member of Farm Bureau Insurance from 1992 to 1994. He is a member of the National Cattlemen's Association, the Texas Cattle Feeders Association, Covington County Cattlemen’s Association, and Seminary Baptist Church.

Experience/Qualifications/Skills: Mr. Parker has served on the board of the Company since its inception in 1995. His experience in the cattle business provides the Board with insight into the needs of the agricultural community in the Company’s markets. His insight into the market in which he lives through his community involvement are important assets to the Board.

J. Douglas Seidenburg, 63, has been a director of the Company since 1998 and is also a director of the Bank.

Background: Mr. Seidenburg has served as the owner and President of Molloy-Seidenburg & Co., P.A., an accounting firm, since 1989. He has been a CPA since 1983. Mr. Seidenburg is involved in many civic, educational, and religious activities in the Jones County area. Past activities include serving as president of the Laurel Sertoma Club, president of the University of Southern Mississippi Alumni Association of Jones County, treasurer of St. John's Day School, director of Leadership Jones County and a member of Future Leaders of Jones County. He was also one of the founders of First Call for Help, a local United Way Agency started in 1990. Mr. Seidenburg is a 1981 graduate of the University of Southern Mississippi, where he earned a B.S. degree in Accounting. Mr. Seidenburg also served as director of The First National Bank of the Pine Belt in Laurel, Mississippi prior to its consolidation with The First.

Experience/Qualifications/Skills: Mr. Seidenburg has served on the Board of the Company since 1998. He is Chairman of the Audit Committee and has been designated as a financial expert. His experience as a CPA and his knowledge of corporate governance provide the Board with an understanding of the financial and accounting issues that are faced by companies in today’s business environment.

Valencia M. Williamson, 42, was named to the Board of Directors of the Bank in February, 2023 and is a nominee for director of The First Bancshares, Inc.

Background: Ms. Williamson is the President and CEO of the Clayton County Chamber of Commerce, Jonesboro, George which serves the fifth largest county in the state of Georgia with seven municipalities and a population of 300,000. The key areas of focus for the Chamber include small business development, education and workforce initiatives, transportation expansion, and increasing organization capacity through regional partnerships, and collaborations. Ms. Williamson served as Executive Vice President for the Area Department Partnership from 2014 to 2020 and served as Vice President from 2010 to 2014. Ms. Williamson is a graduate of the University of Southern Mississippi where she received her Masters in Business Administration and Florida A & M University where she received a Bachelor of Science Degree in Agricultural Business.

Experience/Qualifications/Skills: Ms. Williamson has been successful in effectively implementing innovative and strategic engagement strategies and has experience in nonprofit organization management including fundraising, budgeting, staffing, membership recruitment, engagement and retention program development and implementation, community and government relations. Ms. William’s experience in business development, government relations, and community engagement make her an asset to the Board.

Class III Director Nominee

Jonathan A. Levy, 62, has been a director of the Company since August 1, 2022 and is also a director of the Bank.

Background: Mr. Levy is the Co-Founder and Managing Partner of Redstone Investments, which is a development, management, and acquisitions company with a focus on shopping center development and also includes commercial real estate brokerage which provides asset management services for financial institutions and other third parties. He has been involved in the real estate and construction industry for more than 30 years. Mr. Levy is involved in many civic and educational activities in the Tampa, Florida area and has served as a director of Huntington Bancshares, Inc., Columbus, OH, and GulfShore Bancshares, Inc., Tampa, FL. Mr. Levy is a graduate of Syracuse University where he earned a B.S. degree in finance.

Experience/Qualifications/Skills: Mr. Levy has served on the Board of the Company August, 2022. His experience in commercial real estate development provides the Board with insight into the trends and risks associated with residential, rental and commercial real estate within the Company’s Florida market. Mr. Levy’s experience as a director for a large financial institution is beneficial to the Company as it continues to grow.

Information about Continuing Directors

David W. Bomboy, M.D., 77,78, has been a director of the Company since 1995 and is also a director of the Bank.

Background: Dr. Bomboy is a lifelong resident of Hattiesburg, Mississippi. He received a B.S. with honors in Pre-Medicine from the University of Mississippi in 1968 and earned an M.D. degree from the University of Mississippi Medical Center in 1971. Dr. Bomboy completed his orthopedic surgical training at the University of Mississippi in 1976. He is a board-certified orthopedic surgeon and practiced orthopedics in southern Mississippi for 41 years before his retirement in January of 2019. Dr. Bomboy is a member of the Mississippi State Medical Association, the American Medical Association, and the Mississippi Orthopedic Society. He also served as president of the Methodist Hospital Medical Staff and has served on the Board of Directors of Tatum Development and Merchants Food Service.

| 11 |

Experience/Qualifications/Skills: Dr. Bomboy is the sole physician on the Company’s board which enables him to bring a different perspective to the challenges the board faces. His background, experience, and knowledge of the medical and business communities are important in the board’s oversight of management. His past involvement in real estate development adds additional insight to board oversight and review of the Bank’s loan portfolio.

M. Ray (Hoppy) Cole, Jr., 61,62, has served as director of the Company from 1998 to 1999 and from 2001 through the present and is also a director of the Bank.

Background: Mr. Cole has served as President and CEO of the Company and the Bank since 2009 and has serves as the Chairman of both the Company’s and Bank’s Board of Directors. Prior to joining the Bank in September 2002, Mr. Cole was Secretary/Treasurer and Chief Financial Officer of the Headrick Companies, Inc. for eleven years. Mr. Cole began his career with The First National Bank of Commerce in New Orleans, Louisiana and held the position of Corporate Banking Officer from 1985-1988. In December of 1988, Mr. Cole joined Sunburst Bank in Laurel, Mississippi serving as Senior Lender and later as President of the Laurel office. Mr. Cole graduated from the University of Mississippi where he earned a Bachelor's and Master's Degree in Business Administration. Mr. Cole attended the Stonier Graduate School of Banking at the University of Delaware. He currently servesserved as the chairman of the Mississippi Bankers Association. Mr. Cole also served as director of the First National Bank of the Pine Belt in Laurel, Mississippi prior to its consolidation with The First.

Experience/Qualifications/Skills: Mr. Cole has served on the board of the Company for more than twenty years and has extensive knowledge of all aspects of the Company’s business. His many years of experience in banking and his leadership in building our Company make him well qualified to serve as a director. His insight is an essential part of formulating the Company’s policies, plans and strategies.

E. Ricky Gibson, 66,67, served as Chairman of the Board from 2010 to 2022. He has been a director of the Company since 1995 and is also a director of the Bank.

Background: Mr. Gibson has been president and owner of N&H Electronics, Inc., a wholesale electronics distributor, since 1988 and of Mid South Electronics, a wholesale consumer electronics distributor, since 1993. He attended the University of Southern Mississippi. He is a member of Parkway Heights United Methodist Church.

Experience/Qualifications/Skills: Mr. Gibson has served on the board of the Company since its inception in 1995. As a business owner and distributor, Mr. Gibson is knowledgeable about all aspects of running a successful business and he understands the challenges business owners face. Also, he has developed an understanding of the Company’s bank and the banking industry in general, particularly in the area of audit and executive compensation. He served as Chairman of the Board of both the Company and the Bank and has served as chairman of the Audit Committee of the Bank’s Board of Directors and served as chairman of the Compensation Committee of the Company’s Board of Directors.

Jonathan A. Levy, 63, has been a director of the Company since August 1, 2022 and is also a director of the Bank.

Background: Mr. Levy is the Co-Founder and Managing Partner of Redstone Investments, which is a development, management, and acquisitions company with a focus on shopping center development and also includes commercial real estate brokerage which provides asset management services for financial institutions and other third parties. He has been involved in the real estate and construction industry for more than 30 years. Mr. Levy is involved in many civic and educational activities in the Tampa, Florida area and has served as a director of Huntington Bancshares, Inc., Columbus, OH, and GulfShore Bancshares, Inc., Tampa, FL. Mr. Levy is a graduate of Syracuse University where he earned a B.S. degree in finance.

| 12 |

Experience/Qualifications/Skills: Mr. Levy has served on the Board of the Company August, 2022. His experience in commercial real estate development provides the Board with insight into the trends and risks associated with residential, rental and commercial real estate within the Company’s Florida market. Mr. Levy’s experience as a director for a large financial institution is beneficial to the Company as it continues to grow.

Charles R. Lightsey, 83,84, has been a director of the Company since 2003 and is also a director of the Bank.

Background: Mr. Lightsey has owned his own business, Charles R. Lightsey, Social Security Disability Representative, since January 2000. Mr. Lightsey worked with the Social Security Administration from 1961 to 2000, serving as District Manager of the Laurel Office from 1968 to 2000. He is a recipient of The Commissioner's Citation, the highest accolade accorded by the Social Security Administration. His community involvement includes serving as a former deacon of the First Baptist Church of Laurel, member and Board of Directors of the Laurel Kiwanis Club, president of the Laurel-Jones County Council on Aging, member of the Pine Belt Mental Health Association Council and Chairman of the Federal, State and Local Government United Way. He received his degree in Management and Real Estate from the University of Southern Mississippi in 1961. Mr. Lightsey served as director of the First National Bank of the Pine Belt in Laurel, Mississippi prior to its consolidation with The First.

Experience/Qualifications/Skills: Mr. Lightsey has served on the Company’s board since 2003. His background as a manager with the Social Security Administration and his business ownership experience provide the Board with a broad range of knowledge and business acumen. His business experience has equipped him with the skills necessary to be a leader on the Board and to serve as chairman of the corporate governance committee.

Fred A. McMurry, 58,59, has been a director of the Company since 1995 and is also a director of the Bank.

Background: Mr. McMurry is currently President and General Manager of Havard Pest Control, Inc. a family-owned business where he has served for over 33 years. He also serves on the board of the Bureau of Plant Industry of the Mississippi Department of Agriculture and Commerce and the Dixie National Junior Livestock Sales Committee. In addition, he is President of West Oaks, LLC and Vice President of Oak Grove Land Company, Inc.

Experience/Qualifications/Skills: Mr. McMurry has been a director of the Company since its inception in 1995. He contributes his extensive knowledge of the Lamar County area of Mississippi, which is one of the Company’s primary markets. His many years of small business experience give him a broad understanding of the needs of the Company’s customers as well as insight into the economic trends in the area. He also has been involved in real estate development through his participation in West Oaks, LLC and Oak Grove Land Company, Inc., which adds value to loan discussions. West Oaks, LLC and Oak Grove Land Company, Inc. are real estate holding companies which own and lease several residential and commercial properties in Mississippi.

Thomas E. Mitchell, 75,76, has been a director of the Company since 2017 and is also a director of the Bank.

Background: Mr. Mitchell joined the Board of Directors of the Bank in July 2016. He serves as President of Stuart Contracting Co., Inc., a major area contractor known for large-scale school, government, industrial and commercial projects of all types located in Bay Minette, AL, a position he has held since 1975. Mr. Mitchell is involved in numerous other partnerships and companies and is a part owner in a number of shopping center projects and office parks and various other residential and commercial projects in Alabama. He is a member of First Baptist Church of Bay Minette, where he serves as a deacon.

Experience/Qualifications/Skills: Mr. Mitchell served on the Board of Directors of SouthTrust Corporation from 1996 until 2004 and has served as director for American Fidelity Insurance Company since 2014. Mr. Mitchell’s vast business experience as well as his knowledge of the Alabama and Florida markets is an asset to the Board. Mr. Mitchell’s experience provides the Board with valuable insight into the trends and risks of the market in which he lives and works.

| 13 |

Renee Moore, 62, Hattiesburg, MS, has been a director of the Company since 2020 and is also a director of the Bank.

Background: Ms. Moore, CPA and partner in charge of tax services at Topp McWhorter Harvey, PLLC since 2009, is a resident of Hattiesburg, MS and has more than 30 years of public and private accounting experience. She is active in the community, serving on the Forrest General Foundation Planned Giving Committee, the 2019 Heart Walk Executive Leadership Team, and as an Ambassador for the Area Development Partnership of Greater Hattiesburg. In 2022, she was recognized as a Leader in Finance by the Mississippi Business Journal. She also served as team captain for the Leadership Division of the Area Development Partnership Forward Together Capital Campaign. Ms. Moore earned her Bachelor of Science degree in Accounting from the University of Arkansas at Little Rock.

Experience/Qualifications/Skills: Throughout Ms. Moore’s career, she has held numerous leadership positions. From CFO of a privately-held company to partner in charge of a major service division in the sixth largest firm in the state, her experience in both public accounting and industry, as well as experience gained when she and her husband owned and operated their own business, have given her a unique understanding and perspective. She also has experience as Audit Manager for a national bank. Her experience and skills are a valuable resource to the Board.

Ted E. Parker, 64, has been a director of the Company since 1995 and is also a director of the Bank.

Background: Mr. Parker has been in the stocker-grazer cattle business for more than 45 years as the owner and operator of Ted Parker Farms LLC. He attended the University of Southern Mississippi and served as a licensed commodity floor broker at the Chicago Mercantile Exchange from 1982 to 1983. He served on Bayer Animal Health Advisory Board from 2010 to 2016 and on the Marketing and International Trade Committee of the National Cattleman’s Beef Association from 2015 to 2017 and currently serves on the Cattle Fax board of directors and is on the Nominating Committee. He was the 2018 National Stocker Operator of the Year and the 2019 Mississippi Farmer of the year. He is a member of the National Cattlemen’s Association, the Mississippi Cattlemen’s Association, and Seminary Baptist Church.

Experience/Qualifications/Skills: Mr. Parker has served on the board of the Company since its inception in 1995. His experience in the cattle business provides the Board with insight into the needs of the agricultural community in the Company’s markets. His insight into the market in which he lives through his community involvement are important assets to the Board.

J. Douglas Seidenburg, 64, has been a director of the Company since 1998 and is also a director of the Bank.

Background: Mr. Seidenburg has served as the owner and President of Molloy-Seidenburg & Co., P.A., an accounting firm, since 1989. He has been a CPA since 1983. Mr. Seidenburg is involved in many civic, educational, and religious activities in the Jones County area. Past activities include serving as president of the Laurel Sertoma Club, president of the University of Southern Mississippi Alumni Association of Jones County, treasurer of St. John's Day School, director of Leadership Jones County and a member of Future Leaders of Jones County. He was also one of the founders of First Call for Help, a local United Way Agency started in 1990. Mr. Seidenburg is a 1981 graduate of the University of Southern Mississippi, where he earned a B.S. degree in Accounting. Mr. Seidenburg also served as director of The First National Bank of the Pine Belt in Laurel, Mississippi prior to its consolidation with The First.

Experience/Qualifications/Skills: Mr. Seidenburg has served on the Board of the Company since 1998. He is Chairman of the Audit Committee and has been designated as a financial expert. His experience as a CPA and his knowledge of corporate governance provide the Board with an understanding of the financial and accounting issues that are faced by companies in today’s business environment.

Andrew D. Stetelman, 62, has been a director of the Company since 1995 and is also a director of the Bank.

| 14 |

Background: Mr. Stetelman has served as a Realtor with London and Stetelman Commercial Realtors since 1981. He graduated from the University of Southern Mississippi in 1983. He has served in many capacities with the National, State, and Hattiesburg Board of Realtors, including serving as President in 1987. He was selected as Realtor of the Year in 1992 of the Hattiesburg Board of Realtors and in 2001 he became the first Mississippi Commercial Realtor of the Year. He has served as the chairman of the Hattiesburg Convention Center from 1994 to 2019, and as a board member of the Area Development Partnership from 1997 to 2019. He currently serves on the board of the 3D School and also served as chairman until 2021. Mr. Stetelman is also a member of the Kiwanis International.

Experience/Qualifications/Skills: Mr. Stetelman has been a director of the Company since its inception in 1995. His experience in commercial real estate and real estate investments provides the Board with insight into the trends and risks associated with residential, rental, and commercial real estate within all of the Company’s markets. His broad insight and knowledge related to real estate is very valuable to the Board and its oversight of the Company’s loan portfolio.

Valencia M. Williamson, 43, has been a director of the Company since May 2023 and is also a director of the Bank.

Background: Ms. Williamson is the President and CEO of the Clayton County Chamber of Commerce, Jonesboro, George which serves the fifth largest county in the state of Georgia with seven municipalities and a population of 300,000. The key areas of focus for the Chamber include small business development, education and workforce initiatives, transportation expansion, and increasing organization capacity through regional partnerships, and collaborations. Ms. Williamson served as Executive Vice President for the Area Department Partnership from 2014 to 2020 and served as Vice President from 2010 to 2014. Ms. Williamson is a graduate of the University of Southern Mississippi where she received her Masters in Business Administration and Florida A & M University where she received a Bachelor of Science Degree in Agricultural Business.

Experience/Qualifications/Skills: Ms. Williamson has been successful in effectively implementing innovative and strategic engagement strategies and has experience in nonprofit organization management including fundraising, budgeting, staffing, membership recruitment, engagement and retention program development and implementation, community and government relations. Ms. Williamson’s experience in business development, government relations, and community engagement make her an asset to the Board.

PROPOSAL 2 – Advisory Vote on the Compensation of our Named Executive Officers

Pursuant to Section 14A of the Exchange Act, we provide our shareholders with the opportunity to vote to approve, on a non-binding, advisory basis, the compensation of our named executive officers, as disclosed in this proxy statement in accordance with the rules of the SEC (the “say-on-pay proposal”). This vote does not address any specific item of compensation but rather the overall compensation of our named executive officers and our compensation philosophy and practices as disclosed in the section titled “Executive Officer Compensation.” This disclosure includes the “Compensation Discussion and Analysis” and the “Executive Compensation Tables” set forth below, including the accompanying narrative disclosures. At the 20222023 annual meeting of shareholders, we provided our shareholders with the opportunity to cast a non-binding advisory vote regarding the compensation of our named executive officers as disclosed in our proxy statement for the 20222023 annual meeting of shareholders. Our say-on-pay proposal was approved by approximately 96%97% of our shareholders whose shares were present in person or by proxy at the 20222023 annual meeting and who voted or affirmatively abstained from voting (excluding broker non-votes). We are again asking our shareholders to vote on the following resolution:

RESOLVED, that the shareholders of The First Bancshares Inc. (the “Company”) approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in the proxy statement for the Company’s 20232024 Annual Meeting of Shareholders pursuant to Item 402 of Regulation S-K of the rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and the narrative executive compensation disclosures to the compensation tables included in this proxy statement.

| 15 |

We understand that executive compensation is an important matter for our shareholders. Our core executive compensation philosophy and objectives continue to be designed to reward the achievement of specific annual, long-term and strategic goals by the Company, and which aligns the interests of the executive officers with the Company’s overall business strategy, values and management initiatives intended to reward executives for strategic management and the enhancement of shareholder value and support a performance-oriented environment that rewards achievement of internal goals. In considering how to vote on this proposal, we encourage you to review all the relevant information in this proxy statement, including the “Compensation Discussion and Analysis”, the “Executive Compensation Tables,” and the rest of the narrative disclosures regarding our executive compensation program in the section titled “Executive Officer Compensation”.

While this advisory vote is not binding, the Board of Directors and the Compensation Committee value the opinion of our shareholders and will consider the outcome of the vote when making future compensation decisions for our named executive officers.

Vote Required to Approve, on an Advisory Basis, the Compensation of Our Named Executive Officers:

Proposal No. 2 will be approved if votes cast in favor of the proposal exceed votes cast against it.

Recommendation of the Board of Directors

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

EXECUTIVE OFFICER COMPENSATION

Our named executive officers (“NEOs”) for 20222024 and the positions held by them on December 31, 20222023 are:

M. Ray (Hoppy) Cole, Jr., 61,62, CEO and President of the Company and the Bank, and Chairman of the Company’s and Bank’s Board of Directors. Mr. Cole’s biography is provided above under “Information about Continuing Directors.Director Nominees.”

Donna T. (Dee Dee) Lowery, CPA, 56,57, Executive Vice President and Chief Financial Officer of the Company and the Bank. Ms. Lowery has served as Executive Vice President and Chief Financial Officer of the Company and the Bank since she joined the Company in February 2005. Prior to joining the Company, Ms. Lowery was Vice President and Investment Portfolio Manager of Hancock Holding Company from 2001 to 2005. Ms. Lowery began her career in 1988 with McArthur, Thames, Slay and Dews, PLLC as a staff accountant. In June 1993, she joined Lamar Capital Corporation, and held several positions beginning with Internal Auditor from 1993 to 1995, Comptroller from 1995 to 1998 and then Chief Financial Officer and Treasurer from 1998 to 2001, until the merger in 2001 with Hancock Holding Company. Ms. Lowery graduated from the University of Southern Mississippi where she earned a Bachelor’s Degree in Business Administration with an emphasis in Accounting. Ms. Lowery serves on the Advisory Board for the Business School at the University of Southern Mississippi, and serves on the Board of the Petal Education Foundation, and the Board of the Petal Children’s Task Force.

There are no arrangements or understandings between any of the executive officers and any other person pursuant to which he or she was selected as an executive officer. No executive officer has any family relationship, as defined in Item 401 of Regulation S-K, with any other director or with any of our executive officers.

| 16 |

Compensation Discussion and Analysis

Overview of Compensation Program

The Compensation Committee (for purposes of this analysis, the “Committee”) of the Board of Directors has responsibility for establishing, implementing and monitoring adherence with the Company’s compensation philosophy. The Committee ensures that the total compensation paid to the named executive officers is fair, reasonable and competitive. Generally, the types of compensation and benefits provided to the named executive officers are similar to those provided to other executive officers in publicly traded financial institutions.

20222023 Financial Highlights

| ● |

| In the year-over-year comparison, net income available to common shareholders |

| ● |

| ● |

| ● |

Compensation Philosophy and Objectives

The Committee believes that the most effective executive compensation program is one that is designed to reward the achievement of specific short-term, long-term and strategic goals by the Company, and which aligns the interests of the executive officers with the Company’s overall business strategy, values and management initiatives. The Company’s compensation policies are intended to reward executives for strategic management and the enhancement of shareholder value and support a performance-oriented environment that rewards achievement of internal goals.

The Company has also adopted a Compensation Philosophy that provides guidance to the Committee when making decisions surrounding the compensation of the NEOs. Incentive compensationCompensation (cash and/or equity) is intended to target cash and direct compensation at the 50th percentile when target performance is achieved and between the 60th and 75th percentiles when annual/long-term goals are exceeded. The philosophy has a strong emphasis on incentive compensation programs that provide an alignment between pay and performance.

The Committee evaluates both performance and compensation to ensure that the Company maintains its ability to attract and retain superior employees in key positions and that compensation provided to key employees remains competitive relative to the compensation paid to similarly situated executives of peer companies.

Our executive compensation programs are designed to align the interests of our NEOs with those of our shareholders. Based on our performance, findings from the 20192023 executive compensation review, as adjusted, prepared by Blanchard Consulting Group (“Blanchard”), an independent third party compensation consultant (as discussed in greater detail later in the CD&A), and our commitment to linking pay and performance, the Committee made the following executive compensation decisions for fiscal year 2022.2023. For more detail, please refer to the “2022“2023 Executive Compensation Components” later in the CD&A:

| ● | Base Salaries: Based on performance during |

| 17 |

| ● |

| ● |

Summary of Executive Compensation Practices

Our executive compensation program includes the following practices and policies, which we believe promote sound compensation governance and are in the best interests of our shareholders:

| What We Do | |

| ● | Periodically, compare our NEO compensation levels to the market and take these results into consideration when making compensation related decisions. |

| ● | Provide our NEOs with a performance-based cash incentive plan on an annual basis. |

| ● | Grant full-value equity to each of our NEOs with multi-year vesting provisions. |

| ● | Provide each of our NEOs with supplemental executive retirement plans to encourage retention and promote stability in our executive group. |

| ● | Utilize the assistance of an outside independent compensation consultant to assist our Compensation Committee with gathering market data and best practices information. |

Role of Executive Officers in Compensation Decisions

The Committee annually reviews, determines and recommends to the Board for approval the annual compensation, including salary, incentives (cash and/or equity) and other compensation of the Chief Executive Officer, including corporate goals and objectives relevant to compensation of the Chief Executive Officer, and evaluates performance in light of these goals and objectives.

The Committee and the Chief Executive Officer annually review the performance of each of the named executive officers (other than the Chief Executive Officer whose performance is reviewed by the Committee). The CEO recommends salary adjustments and annual award amounts based on these reviews, other than for himself, to the Committee. The Committee can exercise discretion in modifying or adjusting recommended compensation or awards to executives. The Committee then submits its recommendations on executive compensation to the full Board for approval.

Setting Executive Compensation

Results of Say on Pay Vote in 20222023

The Compensation Committee monitors the results of our annual advisory vote on executive compensation each year. Our advisory say-on-pay proposal at the 20222023 annual meeting of shareholders received an affirmative vote of approximately 96%97% in favor of our 20212022 executive compensation program. As a result, the Compensation Committee did not implement any specific changes to our executive compensation programs based on the 20222023 shareholder advisory vote. The Compensation Committee monitors the results of each year’s say-on-pay proposal vote and considers such results as one of many factors in connection with the discharge of its responsibilities. The Company maintains active engagement with our shareholders, communicating directly with the holders of our outstanding common stock each year regarding the Company’s performance and responding to any questions or issues they may raise. We encourage shareholders to communicate with us regarding our corporate governance and executive compensation. Communications from shareholders on these subjects are reported to the Compensation Committee or the Corporate Governance Committee, as appropriate.

| 18 |

Based on the foregoing objectives, the Committee has structured the Company’s annual and long-term incentive-based cash and non-cash executive compensation to motivate executives to achieve the business goals set by the Company and reward the executives for achieving such goals.

Independent Compensation Consultant

The Committee has retained Blanchard, , an independent third party compensation consultant, to provide research for benchmarking purposes related to executive compensation. Blanchard is a national consulting firm with an exclusive focus on the banking and financial services industry. Blanchard does not provide any services to the Company besides executive compensation consulting services, and reports directly to the Compensation Committee. The Compensation Committee has evaluated Blanchard’s independence, including the factors relating to independence specified in Nasdaq Stock Market Listing Rules, and determined that Blanchard is independent and that their work with the Committee has not raised any conflict of interest.

Additionally, the Company utilizes the Mississippi Bankers Association (“MBA”) survey, which provides the Committee with comparative salary data from the Company’s market areas. The Blanchard and MBA data is used by the Committee to ensure that it is providing competitive compensation comparable to its peer group, thereby allowing the Company to retain talented executive officers who contribute to the Company’s overall long-term success.

In 2019,2023, Blanchard assessed executive officer base salary and total compensation as compared to a peer group of sixteentwenty publicly traded banks. The peer companies included the following:

| 1 | Trustmark Corporation | TRMK |

| 2 | Renasant Corporation | RNST |

| 3 | Hilltop Holdings, inc. | HTH |

| 4 | International Bancshares Corporation | IBOC |

| 5 | ServisFirst Bancshares, Inc. | SFBS |

| 6 | First Foundation, Inc. | FFWM |

| 7 | First Financial Bankshares, Inc. | FFIN |

| 8 | FB Financial Corporation | FBK |

| 9 | Veritex Holdings, Inc. | VBTX |

| 10 | Seacoast Banking Corporation of Florida | SBCF |

| Origin Bancorp, Inc. | OBK | |

| 13 | Amerant Bancorp Inc. | AMTB |

| 14 | Southside Bancshares, Inc. | SBSI |

| 15 | Stock Yards Bancorp, Inc. | SYBT |

| 16 | BancPlus Corporation | -- |

| 17 | Business First Bancshares, Inc. | BFST |

| 18 | Republic Bancorp, Inc. | |

| Community Trust Bancorp, Inc. | CTBI | |

For the 20222023 review of executive compensation against benchmarking data, the Committee reviewed the following summary provided by Blanchard:

| ● | Total Cash Compensation = Base Salary + Annual Cash Incentives / Bonus; |

| ● | Direct Compensation = Total Cash Compensation + |

| ● | Total Compensation = Direct Compensation + Other Compensation + Retirement Benefits / Perquisites |

| 19 |

Blanchard’s 20192023 assessment of FBMS’ compensation practices and levels concluded that:

| ● |

| “Total Cash Compensation” of the NEOs was |

| ● | For “Direct Compensation,” FBMS |

| ● | “Total Compensation” showed that FBMS had |

| ● | FBMS’ financial performance varies versus peers with some metrics near or above the peer group 50th percentile and some near or below the 25th percentile |

The Compensation Committee used Blanchard’s reports and analysis from 2019, as adjusted,2023, to assist with decisions regarding NEO compensation during 20222023 but did not solely rely on such reports and analysis. The ultimate decisions made by the Committee were a balance between the Committee’s compensation philosophy and strategy along with the outside perspective of its independent consultant.

Compensation Policies and Practices as They Relate to Risk Management

The Company’s compensation plans incorporate a balance of profitability and strategic goals, such as core deposit growth, asset quality, and audit/compliance ratings, to ensure the officers of the Company are focusing both on profits and strategic goals that are linked to the long-term viability of the organization.

The Compensation Committee has reviewed with the Bank’s Chief Risk Officer the employee incentive compensation arrangements and has determined that such arrangements do not encourage employees to take unnecessary and excessive risks that are reasonably likely to have a material adverse effect on the Company. The Compensation Committee has adopted the following market practices and policies to reduce risk:

| ● | We align NEO compensation with shareholder interests; |

| ● | We tie the majority of NEO pay to objective, challenging financial goals and Company performance; |

| ● | We avoid excessive risk while designing incentive programs; |

| ● | We maintain stock ownership guidelines for all NEOs; |

| ● | We do NOT provide for excise tax gross-up for “excess parachute payments” under Section 280G of the Internal Revenue Code of 1986, as amended (“Code”) in any new management agreements; |

| ● | We maintain a clawback policy applicable to all NEOs; |

| ● | We utilize an independent consultant to help the Committee understand compensation practices that impact NEO compensation; and |

| ● | We provide for minimum required vesting periods for our equity awards. |

20222023 Executive Compensation Components

Historically, and for the fiscal year ended December 31, 2022,2023, the principal components of compensation for named executive officers consisted of the following:

| ● | base salary; |

| ● | performance-based cash incentive compensation; |

| 20 |

| ● | equity incentive compensation based on achievement of performance targets; | |

| ● | retirement and other benefits; and |

| ● | perquisites and other personal benefits. |

Base Salary

The Company provides named executive officers and other employees with base salary to compensate them for services rendered during the fiscal year.

During its review of base salaries for executives, the Committee primarily considers: 1) performance of the Company; 2) market data as discussed previously; 3) the level of the executive’s compensation, both individually and relative to other officers; and 4) individual performance of the executive. Salary levels are typically considered annually as part of the Company’s performance review process as well as upon a promotion or other change in job responsibility. When reviewing whether to award salary increases, the Committee determines a base salary range and targets the median of the range (50th percentile) for executives that are meeting performance expectations and the upper quartile of the range (75th percentile) for executives that are high performers or exceeding performance expectations. Base salary ranges for named executive officersNEOs are determined for each executive based on the Company’s peer group and the competitive market for executives at similarly sized financial institutions performing similar job duties. Merit based-increases to salaries of the named executive officersNEOs are based on the Committee’s assessment of the individual’s performance. Salary reviews are typically performed in the fourth quarter of the year for which the executive’s performance is evaluated, and corresponding salary adjustments are made during the same quarter of the fiscal year. The chart below shows salary adjustments in connection with performance reviews completed in fiscal year 2022.

The base salaries for each of the named executive officersNEOs effective for the majority of fiscal year 20222023 were approved in the fourth quarter of 20212022 based on fiscal year 20212022 performance. As previously disclosed, the Committee recommended to the Board and the Board approved the following base salaries for 2021:2022:

| 2020 Base Salary | 2021 Base Salary | % Increase | 2021 Base Salary | 2022 Base Salary | % Increase | |||||||||||||||||||

| M. Ray (Hoppy) Cole, Jr. | $ | 520,078 | $ | 572,086 | 10 | % | $ | 572,086 | $ | 629,295 | 10 | % | ||||||||||||

| Donna T. (Dee Dee) Lowery | $ | 295,000 | 319,199 | 8.2 | % | $ | 319,199 | 351,119 | 10 | % | ||||||||||||||

In light of the performance of the Bank in fiscal year 2022,2023, and the NEO’s contributions to the Bank’s strategy, including completion and negotiation of acquisitions during the fiscal year, the Committee recommended to the Board and the Board approved, the following base salary adjustments effective 4th quarter, 2022:2023:

| 2021 Base Salary | 2022 Base Salary | % Increase | 2022 Base Salary | 2023 Base Salary | % Increase | |||||||||||||||||||

| M. Ray (Hoppy) Cole, Jr. | $ | 572,086 | $ | 629,295 | 10 | % | $ | 629,295 | $ | 749,438 | 19 | % | ||||||||||||

| Donna T. (Dee Dee) Lowery | $ | 319,199 | $ | 351,119 | 10 | % | $ | 351,119 | $ | 413,438 | 18 | % | ||||||||||||

Performance-Based Cash Incentive Compensation

The Company has established an incentive cash compensation plan that is based upon individual performance as well as Company performance. Cash incentives are awarded on an annual basis during the year following the year in which the services were performed and are contingent upon such executive officer's continued employment with the Company through the date of payment.

During the first quarter of 2022,2023, independent directors of the Board, upon the recommendation of the Compensation Committee, established short-term cash incentive awards for the NEOs as percentages of their 20222023 base salary, as reflected in the table below. The short-term cash incentive award opportunities for 20222023 were the same as those in place for 2021.2022.

| 21 |

| Threshold | Target | Maximum | ||||||||||

| M. Ray (Hoppy) Cole, Jr. | 30 | % | 45 | % | 60 | % | ||||||

| Donna T. (Dee Dee) Lowery | 15 | % | 22.5 | % | 30 | % | ||||||

Fiscal year 20222023 performance goals for the NEOs for the cash-based incentive plan included Bank pre-tax net income, loan growth, and deposit growth, each described in greater detail below.on the following page. The metrics chosen represent company growth in earnings, assets, and deposits.